utah state solar tax credit 2019

Wait another year and the Utah state credit amount falls further. Like the utah solar tax credit customers dont need to owe the full amount in the.

Utah Solar Tax Credit Everything You Need To Know About

Write the code and amount of each apportionable nonrefundable credit in Part 3.

. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply. Photovoltaic installations completed by Dec. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower.

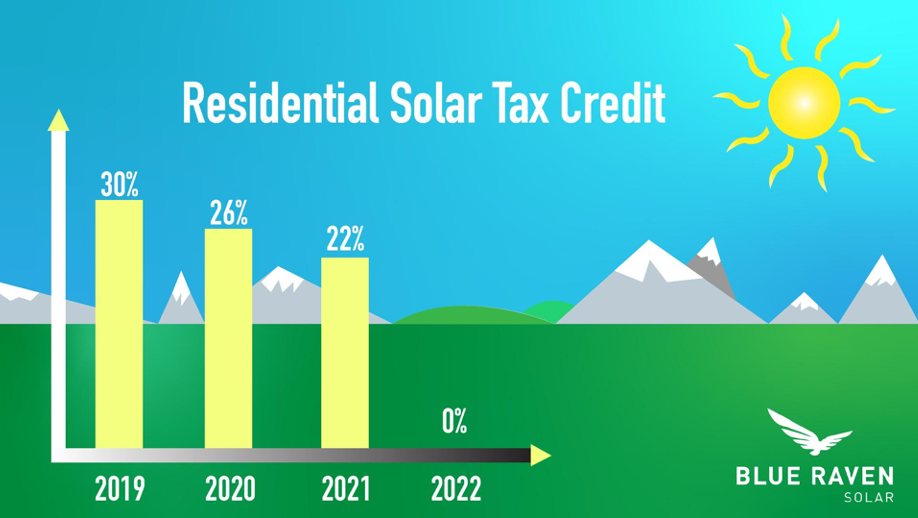

State Tax In Utah the solar investment tax credit ITC is calculated as 25 percent of the eligible system with a 2000 maximum. Ad Enter Your Zip Code - Get Qualified Instantly. If you are starting a solar system project in 2021 but the completion date is 2022 the credit will be 22.

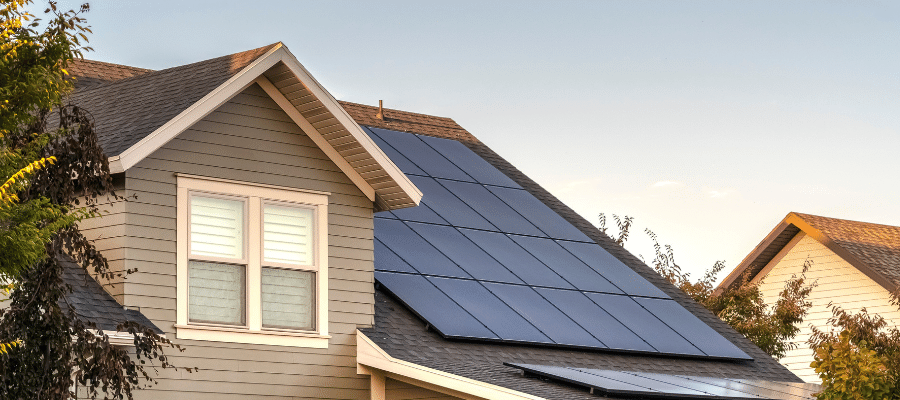

Utahs solar tax credit currently is frozen at 1600 but it wont be for long. And because of the climate it is among the sunniest states in the countrys solar belt. It involves filling out and submitting the states TC-40 form with your state tax returns each year.

State All of Utah can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation costs for an unlimited amount. Please contact us at 801-297-2200 or taxmasterutahgov for more information. The process to claim the Utah renewable energy tax credit is relatively simple and straightforward to follow.

Utah Tax Rate. In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up to 2000. The Utah State Tax Commission offers a tax credit for renewable energy systems including solar.

Do not send form TC-40E with your return. Utah Sales Tax Exemptions If youre looking for yet another reason to go solar in Utah the state offers tax exemptions on PV systems that have a 2MW capacity or greater. Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach.

The process to claim the Utah renewable energy tax credit is relatively simple and straightforward to follow. Utah Code 59-10-1014 This credit is for reasonable costs including installation of a residential energy system that supplies energy to a Utah residential unit. This is 26 off the entire cost of the system including equipment labor and permitting.

The 2018 Utah Legislature passed HB 293 lowering the state individual income. This credit will step down over time and eventually drop to zero for systems that are installed after January 1 2024. Utah customers may also qualify for a state tax credit in addition to the federal credit.

By Tracy Fosterling on Mar 28 2018. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Rooftop solar installations are eligible for a 30 federal tax credit and a 25 state tax credit capped at 1600.

Current federal and Utah solar tax credits offer an incentive to invest now. Is a post-performance non-refundable tax credit for 75 of new state tax revenues including state corporate sales and withholding taxes over the life of the project or 20. Residential tax credits span rooftop solar as well as installations utilizing solar thermal wind geothermal hydro and biomass technologies.

Renewable energy systems tax credit If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. Renewable Energy Systems Tax Credit ENERGY EFFICIENCY FINANCING Public and private building financing and loans as well as incentives offered by Utahs utilities. You can receive a maximum of 1000 credit for your purchase.

For installations completed in 2021 the maximum tax credit will be 1200. 31 2019 are eligible for just 1200. Table created with TablePress developed by Tobias Bäthge.

However the Utah tax credit can change yearly and is expected to drop. Utah has a state tax credit for solar. The Utah credit is calculated at 25 of the eligible cost of the system or 1200 whichever amount is less.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. In other words you will receive one-fourth of the total cost of your home PV system. 2018 Utah Legislature passed HB 2003 creating a Utah personal exemption for dependents that qualify for the child tax credit on a fi lers federal return.

Utah Solar PV Rebates Incentives Data from DSIRE. But that sun also makes Utah an ideal state for solar energy development. As an example we will assume that the gross cost of your solar system is 25000.

The Federal Tax Credit brings a 26 credit until the end of 2021 for all fully installed and completed solar system installations. According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable-energy-systems You can get Form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp. Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not exceed certain limits.

The Utah tax credit for solar panels must be used within 3 years of the purchase date of the solar panels. The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less. Both of these tax credits will decrease over the next few years and end in 2025.

The bill extends the cap on the maximum credit each residential solar system can claim under the 25 solar tax credit by two years. Attach TC-40A to your Utah return. Add the amounts and carry the total to TC-40 line 24.

Install your solar energy system by the end of 2020 and you can claim up to 800. Upcoming Forms Pubs Others Saving Data on Forms Follow us on Twitter For security reasons Taxpayer Access Point and other e-services are not available in most countries outside the United States. Check Rebates Incentives.

Check 2022 Top Rated Solar Incentives in Utah. The Utah tax credit for solar panels is 20 of the initial purchase price. For home PV installations completed in 2021 the Utah state ITC is limited to 400.

And on it goes. This amount decreases by 400 each year after until it expires. To claim your federal tax credit you are required to complete IRS Form 5695 when lodging your tax return.

Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit. It involves filling out and submitting the states TC-40 form with your state tax returns each year. This bill provides stability for the Utah solar market.

Enter Your Zip See If You Qualify. This form calculates tax credits for a range of different residential energy improvements including solar energy systems. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units.

There may still be other local rebates from your city county or utility. You can claim 25 percent of your total equipment and installation costs up to 800. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of 2023.

The credit amounts to 25 of the total system costs up to a maximum of 1600. There is no tax credit on solar panels that you purchase and then sell to someone else.

Utah Solar Utah State Incentives Prices Savings

Solar Tax Credits 2020 Blue Raven Solar

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Understanding The Utah Solar Tax Credit Ion Solar

360 Business Innovation At The Forefront Of The Energy Transition Bringing Solar To The Local Level Mitsui Co Ltd

Solar Tax Credit Details H R Block

Residential Energy Credit How It Works And How To Apply Marca

Federal Solar Tax Credit Guide Atlantic Key Energy

How Does The Utah Solar Tax Credit Work Iws

Understanding The Utah Solar Tax Credit Ion Solar

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

Utah Solar Tax Credit Everything You Need To Know About

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

California Solar Incentives And Rebates Available In 2022

A Short History Of Solar Energy Harvesting Pdh Class

Groups Selected For Nyserda S Clean Energy Integration Challenge Lắp đặt điện Mặt Trời Hcm Khải Minh T Energy Research Future Energy Renewable Energy Resources

Solar Incentives In Utah Utah Energy Hub

Connecticut Solar For Commercial Businesses A Look At 2021 Incentives And Regulatory Policy Genie Solar Energy